How To Add An Additional Insured

Is a venue or event asking you to add them as additional insureds to your photography or videography insurance policy? No worries! Here’s a quick walkthrough showing how to add an additional insured to your policy, whether you’re a current or new Full Frame Insurance customer.

Current Customers

- Log in to your dashboard.

- Click on the “Add additional insureds” button under the “Manage Policies” section.

- If you’re adding more than one additional insured, click on “Add unlimited additional insureds.”

- Select the type of additional insured you’re adding. Then, add their contact information.

- Once you’ve finished adding your additional insureds, you can make a payment. For annual policies, one additional insured is $15 and unlimited additional insureds are $30. For event policies, adding one or unlimited additional insureds costs $5.

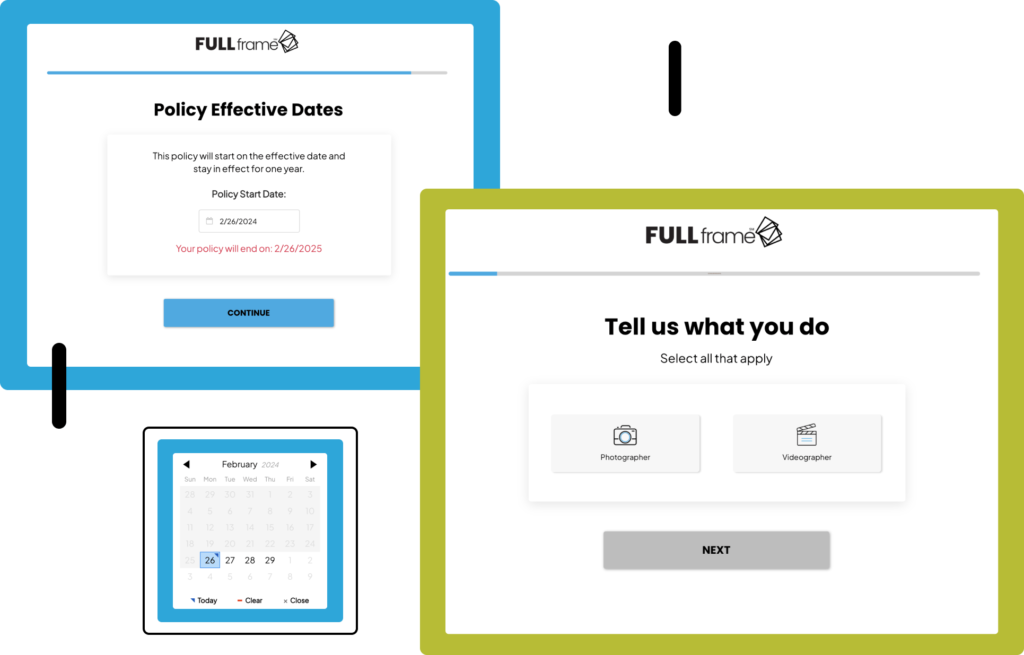

First-Time Customers

- When completing your Full Frame Insurance application, you’ll be asked if you want to add additional insureds to your policy.

- Add the additional insured information.

- For an annual policy, choose your payment of $15 for one or $30 for unlimited. For event policies, pay $5 for one or unlimited additional insureds. This cost will appear on your final checkout screen.

Missed this step while applying? No problem — you can add additional insureds from your dashboard at any time by following the instructions in the video above.

FAQs

Additional insureds are events, organizations, landlords, or venues that may request you to add them to your policy. Note: Additional insureds are not yourself, employees, friends, spouses, or other personal businesses.

Organizations, venues, events, or landlords can request you to add them as an additional insured as a requirement to work with them. You only have to add them if requested. If something goes wrong during your photo shoot or videographer session, your additional insured is covered.

It costs $15 to add one additional insured or $30 for an unlimited amount for your annual Full Frame Insurance policy. It only costs $5 for one or unlimited additional insureds on your event policy.